- Newsroom

- Published on:

Industry 4.0: the DACH region risks falling behind

- Study shows: industrial companies continue to make progress internationally in the use of Industry 4.0 technology – despite the difficult market conditions

- China and the USA continue to increase their lead over the DACH region in all criteria assessed in terms of Industry 4.0

- A lack of skilled workers and legacy systems that are difficult to replace are slowing developments in the DACH region in particular

- The need to catch up is also clear in the context of this year’s focus topic “Data-Driven Production”: German-speaking countries suffer from a lack of data expertise

Ludwigsburg / Munich – According to the overall value of the MHP Industry 4.0 barometer, the degree of digitization in industry is increasing worldwide, although not as quickly as before. China and the USA are continuing to extend their lead over the DACH region. And in the German-speaking countries in particular, a shortage of skilled workers and legacy systems are hindering the expansion of data-driven production.

Such are the key findings of the Industry 4.0 Barometer, which has been published by management and IT consultancy MHP in collaboration with Ludwig-Maximilians University Munich (LMU). A total of 823 people from industrial companies in China, the USA, Germany, Austria, Switzerland and the United Kingdom participated in the study. The study records the prevalence and maturity of the Industry 4.0 technology, makes the status quo comparable between countries, and highlights the developmental trends since 2018. Specific recommendations for action and success stories from user companies as well as interviews round off the study for decision-makers.

Markus Wambach, Group COO at MHP: “We have now been publishing the barometer with LMU Munich – which initially mapped the Germany-wide Industry 4.0 benchmark and has been measuring and comparing the level of maturity internationally since 2021 – for seven years. On the one hand, the barometer serves as a bulletin for companies, highlighting current developments and challenges. On the other hand, companies can also refer to it to find out what they need to do to avoid falling behind the international competition. This is particularly clear when it comes to the digital twin: while 30 percent of companies in the DACH region still go without digital mapping altogether, in China the proportion is just 5 percent. DACH companies are also behind the curve in other areas, such as automation and data analysis. And the DACH region lags behind in general data strategy and data quality in particular – a clear competitive disadvantage. From the perspective of international comparison, companies that fail to catch up run the risk of being left behind.”

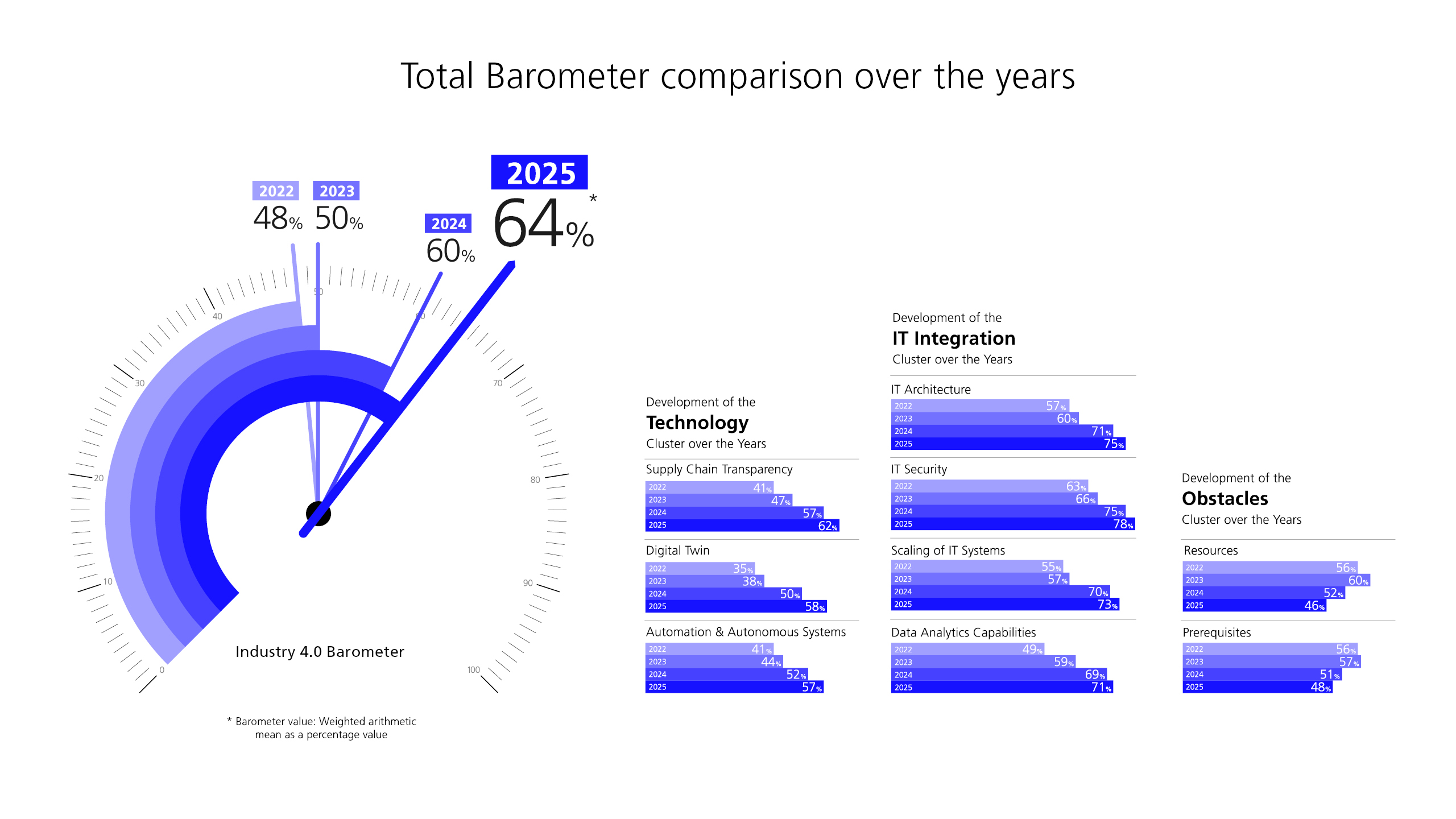

In terms of the status quo of Industry 4.0, the current barometer has an overall value of 64 percent. It was previously 60 percent across all the topics examined, including technology, IT integration and obstacles. In comparison with previous years, the value has increased significantly, although more slowly than in previous years: between 2023 and 2024, for example, a leap from 50 to 60 percent occurred. This means that the technological developments are also advancing more slowly at the international level than before.

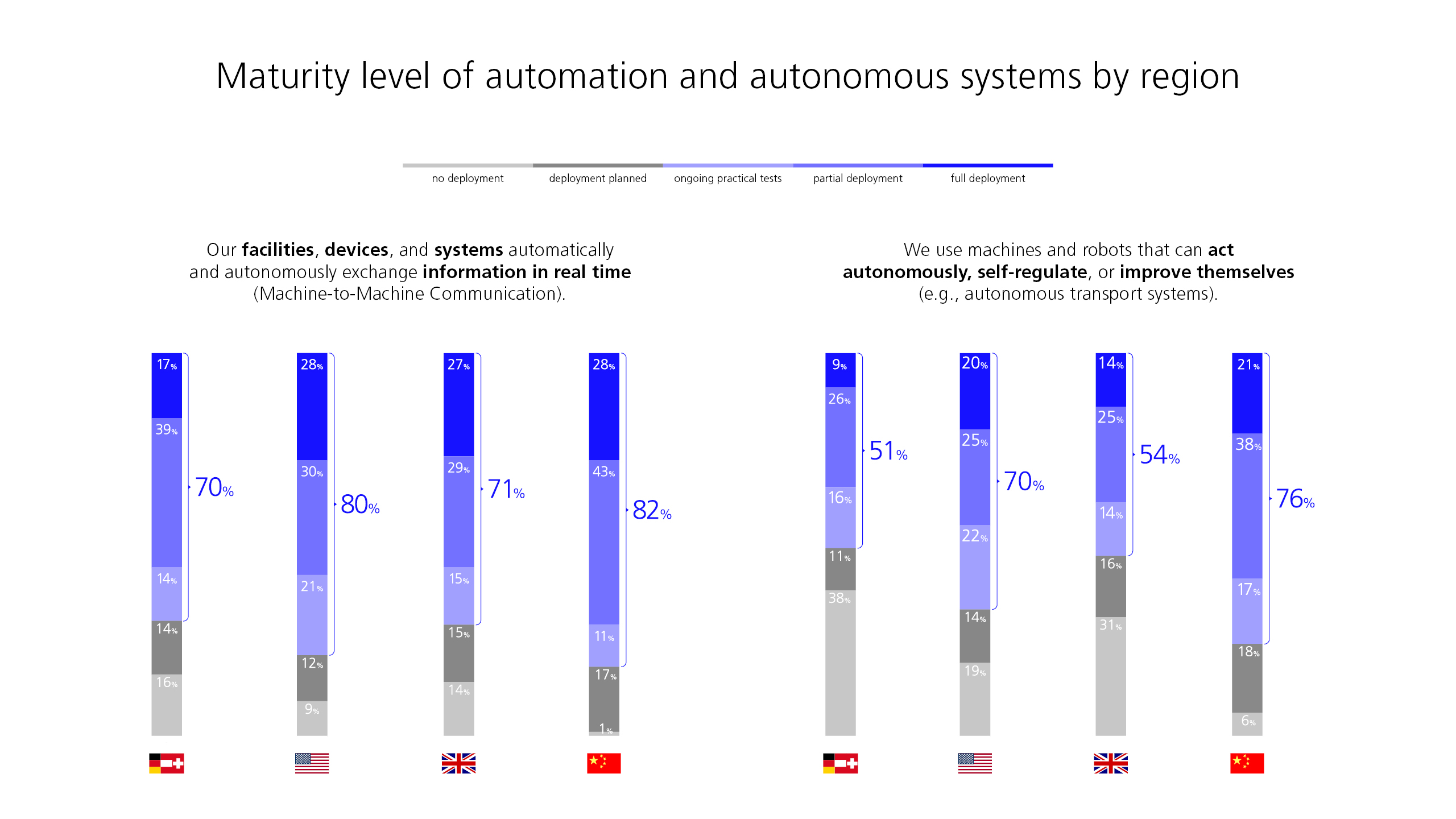

An example of China’s technological lead can be seen in driverless transport systems (DTS), which are responsible for intralogistics operations either in whole or in part in 59 percent of industrial companies in China, while the proportion in the DACH region is just 35 percent – with an average usage rate of 50 percent across all countries examined. The situation is similar when it comes to the digital twin: 67 percent of the participating Chinese companies use digital twins in their production facilities either partially or wholly. The proportion in German-speaking countries, by contrast, is just 41 percent.

Focus topic of data-driven production

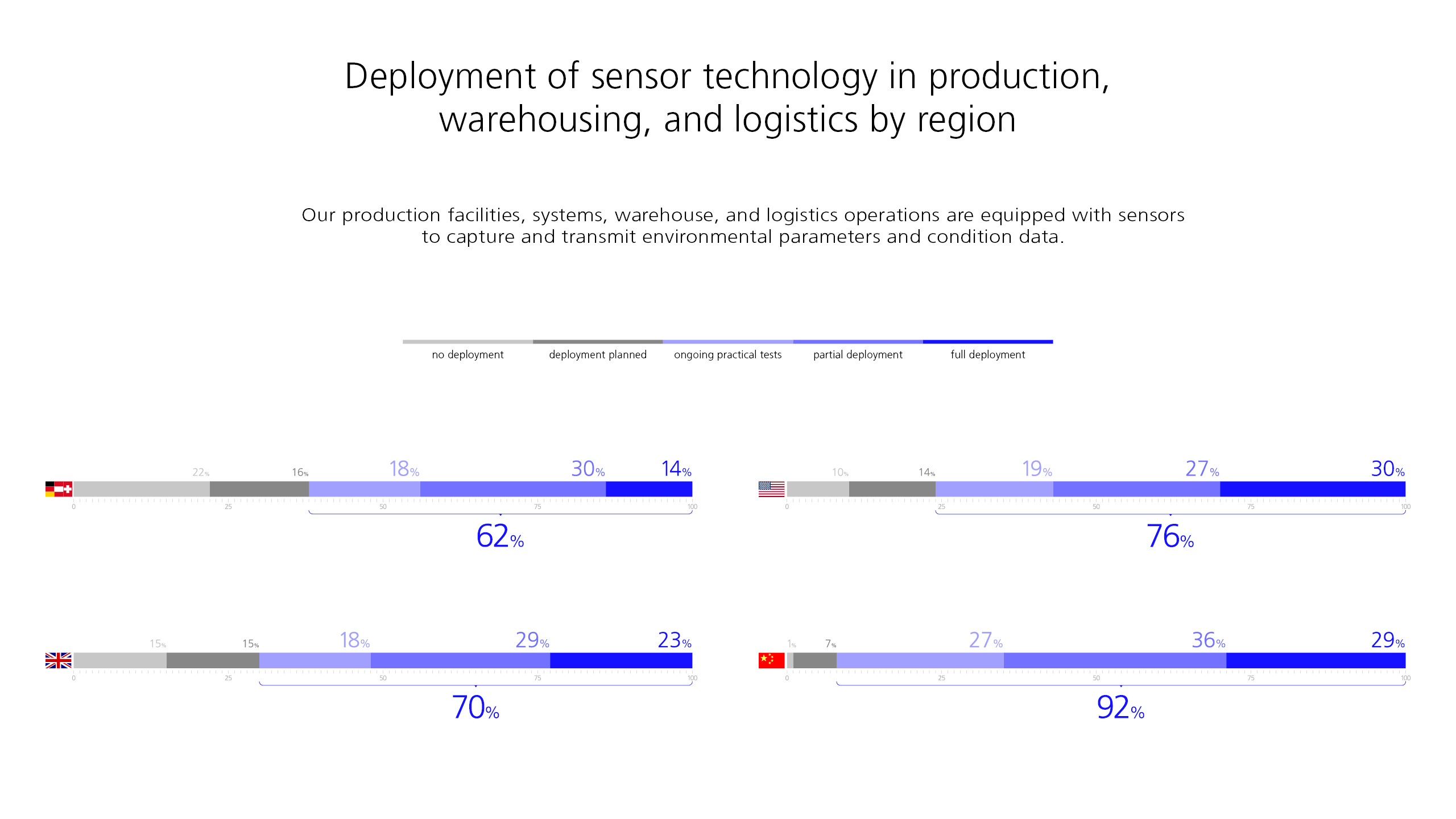

Although considerable progress has been made in almost all areas of the Industry 4.0 in recent years, this year’s findings demonstrate that the data analysis capabilities are improving more slowly in comparison. This year’s focus topic of data-driven production addresses this fact and asks how companies can make effective use of their data along the value chain with the goal of optimizing their production.

At the international level, it is clear that the majority of respondents consider a data-related competitive advantage a clear benefit: 80 percent believe detailed insights into core processes offer a key source of added value, 76 percent believe that they support faster and more reliable decisions, and 74 percent believe that they ensure increased responsiveness to the market. The motivation for ensuring an increased degree of data-driven production therefore exists.

Although many DACH companies have data, they are not making sufficient use of it to support data-based decisions or to drive innovation. Above all, a holistic data strategy that targets future technologies (AI, digital twins) is lacking. This is an area in which US and Chinese companies are more advanced: 91 percent of US companies view data as a strategic asset, compared with 78 percent in China and 64 percent in the DACH region.

“Many DACH companies are yet to have arrived in the digital world in terms of their technology, personnel or organization. Key tasks such as dissolving data silos, replacing legacy systems and setting up a scalable data infrastructure are being put on the back burner instead of being addressed decisively,” explains Dr. Johann Kranz, Professor of Business Information Systems at LMU Munich. “Regrettably, the good economic conditions in the previous decade were not harnessed for long-term investments in more efficient production processes. In the current situation, everything that isn’t considered essential for companies’ survival seems to be being cut.” There are also clear regional differences in the maturity of data analysis skills. This is an area in which the DACH region in particular is significantly behind the curve. While in the US, some 78 percent of respondents rate their skills as superior to the competition, in the DACH region this is only the case for 61 percent.

“The study results show that many companies, especially in the DACH region, need to both accelerate and prioritize their digital transformation. The international comparison shows how rapidly the USA and China are making progress and consolidating their Industry 4.0 leadership positions,” explains Dr. Christina Reich, professor at the FOM University of Applied Sciences for Economics and Management and a Manager at MHP. While these countries benefit from regulations that encourage innovation and targeted investments, companies in the DACH region and the United Kingdom continue to struggle with structural obstacles. Outdated IT infrastructure, a shortage of skilled workers and in many cases inadequate prioritization by management are the biggest challenges. This is particularly evident in the automotive sector and in smaller companies.

About the Industry 4.0 Barometer 2025

The Industry 4.0 Barometer 2025 is published by MHP management and IT consultancy in collaboration with LMU Munich. The survey was conducted for the seventh time in 2024 and involved 823 participants from industrial companies in China (205), the USA (201), the DACH region (216) and the UK (201).

For the purpose of comparability each year, the survey questionnaire covers the four topic clusters of technology, IT integration, strategy and goals, and obstacles and drivers. In addition, the focus topic of Data-Driven Production was explored in greater depth this time. The empirical part is supplemented with interviews with experts and the presentation of successful Industry 4.0 use cases.

MHP at Hannover Messe 2025 #HM25

The world’s leading trade fair for the industry, Hannover Messe, is taking place this year from March 31 until April 4. Approximately 4,000 companies from engineering, the electrical and digital industry, and the energy sector will showcase their technologies and solutions for an interconnected and climate-neutral industry. MHP will once again be present together with its strategic partner Amazon Web Services (AWS) (hall 15, booth D76) to demonstrate various approaches and solutions within the scope of Industry 4.0.

We are happy to provide further information and arrange interviews with MHP experts at any time upon request.

The study can be downloaded here: Industry 4.0 Barometer 2025: Data-Driven Production

MHP Newsroom

Need information about MHP or our services and expertise? We are happy to help and will gladly provide you with current information, background reports, and images.